DevvDigital Has, For the First Time, Solved Blockchain’s Security Flaws

Blockchain is fraught with risks, making security and safety a constant concern for users. One of the biggest challenges for safety and security comes from the management of private keys. Unlike traditional financial systems that offer password resets or fraud protection, the protection of private keys represents a single point of failure in blockchain. Losing a private key means permanent loss of funds, with no way to recover access1. In contrast, private keys are often compromised through many different types of criminal attacks, leading to the theft of all of one’s assets2. Even if a key is secure, assets can still be stolen through other types of hacks, such as with the recent Bybit exploit, where attackers stole $1.5 Billion in assets2. This creates an ongoing trade-off between security and accessibility – stronger protection against theft often makes loss more likely and recovery more difficult, while easier access increases vulnerability to hacks and phishing attacks. As a result, blockchain users must carefully navigate this balance, using tools like hardware wallets, multi-signature setups, and secure backup strategies, all while accepting that no system for managing private keys is entirely foolproof. Innately, theft risk is directly balanced against loss risk, no matter the approach1,2.

Blockchain has many other types of risks. Keeping assets on an exchange or other platform also carries risks – if the platform is hacked2,3 (ByBit, Mt Gox, etc), goes bankrupt3,5 (Genesis, BlockFi, etc) or engages in fraud3 (FTX, Celsius, etc), users can lose everything. Smart Contract and bridging vulnerabilities and exploits have led to billions in losses2. Ransomware attacks, kidnappings, and physical threats have been used to force users to succumb to attacker demands2. Beyond security threats, simple user errors or transaction manipulation can also be catastrophic. Sending a transaction to the wrong or inactive address results in irreversible loss6, as blockchain transactions cannot be undone. Front running, as an example, allows the manipulation of trade execution for profit at the expense of regular users3. Phishing and site lookalikes trick users into permanently transferring assets2,6. Privacy represents another security risk but also a challenge in maintaining regulatory compliance4. Given blockchain’s public nature, transaction owners can be reverse engineered, and this lack of true privacy creates unacceptable risk for institutions4. With no centralized safety net, the decentralized nature of blockchain demands extreme caution, yet even the most careful users remain vulnerable to unforeseen risks1,2,3,4,5,6.

Billions of dollars are lost or stolen every year, and these risks are simply unacceptable to traditional financial companies. DevvDigital provides a one-stop solution for all of the problems described above (as indicated with the given superscript numbers, per below).

A New Mentality For Blockchain Safety and Security

Blockchain users have assumed that these problems are innate and have assumed that the use of cryptographic keys means that theft and loss are unsolvable problems and unavoidable risks, that the public nature of blockchain prevents true privacy, and that there is no way to prevent the use of middlemen when trading assets. These assumptions are wrong. In order for traditional financial institutions to fully embrace blockchain and tokenization, these problems must be solved. DevvDigital has implemented an innovative design of the blockchain itself that solves these problems:

- Loss Protection: For the first time, there is recourse for private key loss, but given the innovative design, there is no need for actual trust of a third party. In combination with Theft Protection, these two features create a layer of safety beyond key management, which doesn’t exist anywhere else in the blockchain space. Read More

- Theft Protection: DevvDigital provides recourse for the theft of assets. Because users can customize a defined and safe use of their funds, attackers cannot force improper use of assets, even with physical force. Both hacking and physical force therefore become ineffective. The combination of loss protection and theft protection removes private key management as the sole approach for implementing security. Read More

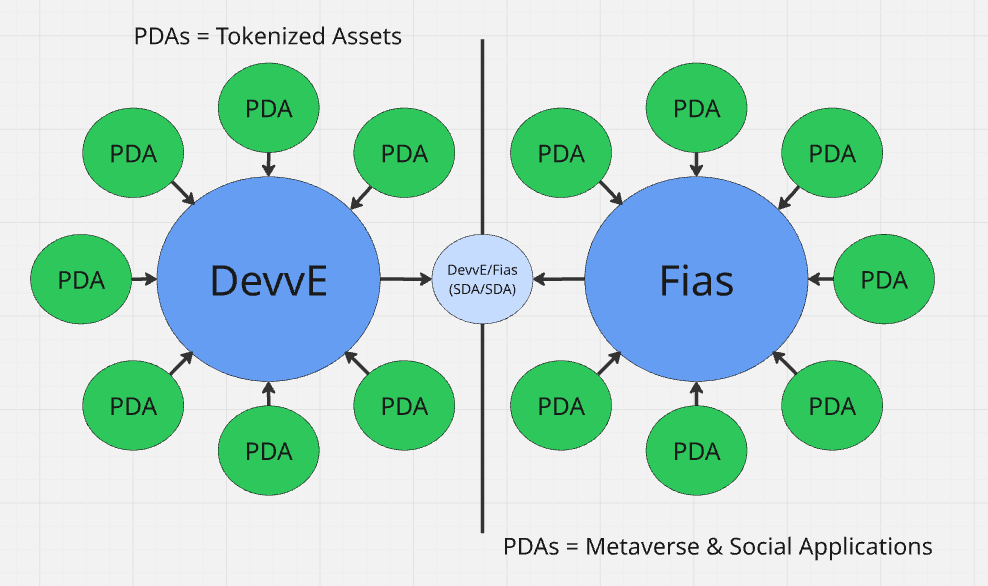

- Non-Custodial Swaps: Any two parties can exchange assets with no middlemen, no settlement risk, and with mathematically instantaneous settlement. Our Contingent Transaction Set (CTS) invention allows for this revolutionary implementation, forever changing global asset exchange. Omnibus wallets are no longer needed, and users directly control their own funds. Many types of manipulation are prevented. Bankruptcies and corporate fraud no longer mean that assets are forever lost. Read More

- Privacy: Our globally patented privacy solution allows for regulatory compliant privacy, a critical need for businesses. Read More

- Bailment: DevvDigital’s management of wrapped tokens includes a revolutionary approach in which DevvDigital itself is entirely removed from the custody process. Even in the extreme case of bankruptcy, users’ assets are fully protected and available.

- Fraud Protection: Transactions themselves can be implemented with escrow functionality allowing recourse if a purchased item is not delivered or if an incorrect receiving address is used.

All of these features innately give users full control of their assets and are underpinned by the common crypto refrain, “not your keys, not your crypto”. The DevvDigital approach also, however, gives the added flexibility of defining personalized security and safety features that do not exist anywhere else in the blockchain and crypto space. Wallets can be set up where there is recourse for blockchain’s biggest security challenges.

For the first time, therefore, traditional finance entities have a solution for both themselves and for their customers, that allows them to fully embrace blockchain technology and the tokenization of Real-World Assets.

Source: https://devv.exchange/blockchain-has-been-too-risky-for-traditional-finance-until-now/