In January 2023, the European Union adopted the Corporate Sustainability Reporting Directive (CSRD), which requires EU and non-EU companies with activities in the EU to file annual sustainability reports alongside their financial statements. These reports must be prepared in accordance with European Sustainability Reporting Standards (ESRS).

This trend will continue and will have global implications.

As early as 2022 PWC recognised both the potential and issues associated with Global ESG investments, with assets under management expected to rise to $33.9 Trillion US by 2026 and demand clearly outstripping supply. 2022 PWC statement

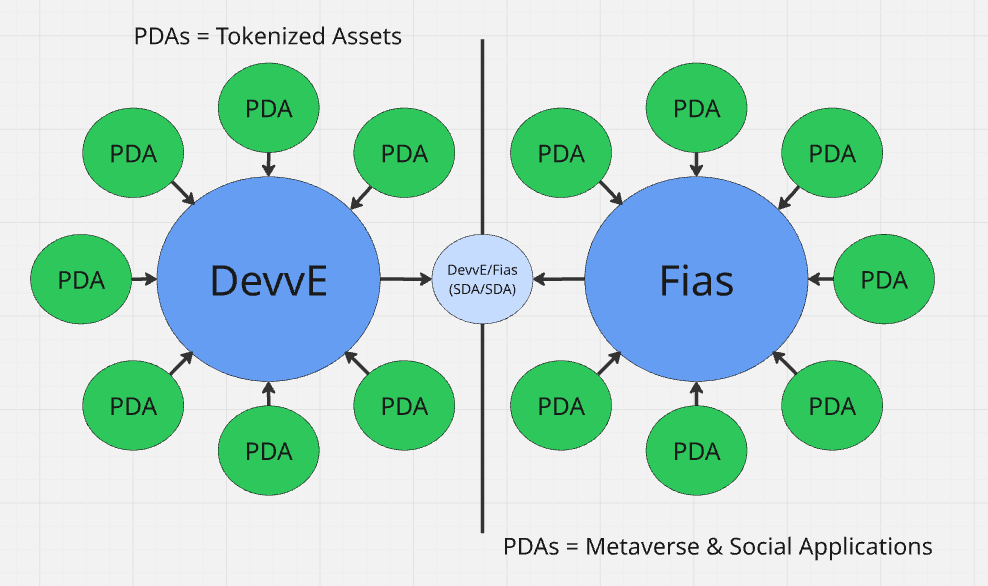

DevvE’s mission is to use the DevvE token to power the growth of the ESG ecosystem by allowing the world to create, exchange, capture and share in collective value and aligned interests through the creation and growth of impact ESG assets.

Over the past 5 years our team has built and engineered a game changing ecosystem utilising market leading blockchain technology that easily eclipses anything currently available by orders of magnitude across every benchmark.

At the heart of this ecosystem is the DevvE token which is scheduled for imminent release. The Forevver Association have been working hard behind the scenes to secure regulatory approvals for the public sale of tokens and the subsequent TGE and exchange listing which will not only bring DevvE to market it will also enable the team to take the next step in bringing our solution online which will benefit all of the stakeholders in the ESG ecosystem.

Ahead of the public sale and TGE event which is tentatively scheduled for January 2024 we are opening an expression of interest form which will allow members of the community who are interested in acquiring the token pre launch to add their details for whitelist consideration.

It is worth mentioning that we fully anticipate demand for the token to outstrip supply. Registering your expression of interest via the form does not mean that you will automatically have a place on the whitelist, nor does it mean that you will be given an allocation that matches any allocation that you may have requested.

Our intention is to make this process as clear and transparent as possible, we would very much like to balance the supply with the demand and ensure that anyone who is interested in participating will have the opportunity to do so.

This is why we have provided the following top level outline for the public sale and attempted to answer any questions you may have. For more detailed information please refer to the Whitepaper or check our social media channels.

DevvE Public token sale

For ease of integration the DevvE token will be launched on the Ethereum network. We fully expect these tokens to be swapped for native DevvE in the future and will provide plenty of time and opportunity for this to happen.

* All tokens sold will be immediately unlocked.

Tokens Available — 2,500,000 + DevvE initial fund sale (discretionary to reach hard cap if needed)

Price — $0.40

Total Supply @ TGE — 11,575,500 (based on 2.5m tokens sold)

Total Supply @ TGE — 19,075,500 (if hardcap is reached)

Market Cap @TGE — $4,630,200 (based on 2.5m tokens sold)

Market Cap @ TGE — $7,630,200 (if hardcap is reached)

Soft Cap — $500,000

Hard Cap — $4,000,000

DevvE initial fund sale explained

10,000,000 tokens have been set aside to support any unanticipated demand up to the $4 million Hard Cap.

The fund sale will be leveraged to support the set up of the fund and onboard some of the first enterprise clients.

How it will work

Those interested in purchasing tokens will need to register their details via our “expression of interest form”. There is a link to the form at the bottom of this article and also on the DevvE social media channels.

We will not require KYC at this stage however this will be a prerequisite for completing the whitelisting process should you be successful.

We will be collecting the following information:

Name:

Email address:

ERC20 Wallet address:

Requested Allocation amount:

Social Media Handle: TG/Twitter or both

Country of Residence:

It is vitally important that prospective registrations are completed with valid credentials. Disposable mail should be avoided as important information will be communicated to those who register concerning details of the sale. Emails will also be sent containing opportunities to complete additional tasks such as referrals, social media shout outs and quests which may be performed.

It is also important to note that the DevvE public sale will comply with the regulations outlined by the AMF and will be managed by our fully compliant partner Kamea Labs based in France. This means that there will be a list of criteria and jurisdictional limitations published which will govern who may participate in the sale.

Whitelist and Waitlist

The expression of interest form will remain open until January 12, 2024 at which time we will not be accepting any further registrations. Those who enter early will be placed ahead in terms of priority and in the likely event that we are oversubscribed, those who miss out will be placed on a “waiting list”.

The waiting list will become active in the event that any whitelisted registrant drops out. Waitlisted people will be notified by email and given 24 hours to claim their whitelisting space.

Whitelisting

We anticipate that the whitelist will open at the conclusion of the expression of interest phase. The whitelist phase should be a shorter process and will immediately precede the public sale.

For those who qualify and are offered a place on the whitelist you will receive an email with a link and details which confirm your opportunity. You will then need to submit (or verify) your details and complete KYC.

Once you have completed the whitelisting, participants will be required to place their funds into escrow in anticipation of the public sale.

Public Sale

The Public Sale, TGE and subsequent exchange listings times and dates will all be announced prior to the closing of the expression of interest form.

Those who have successfully completed the whitelisting and have deposited their funds in escrow will be notified that the public sale is open. If they have approved the transaction there will be no need for any further action and their DevvE tokens will be distributed once the token sale has closed.

Soft Cap

Should DevvE for some reason fail to reach the soft cap outlined above, all participants will be entitled to a refund of their purchases.

Hard Cap

In the highly likely event that we hit our hard cap, the Forevver Association will determine a fair and reasonable distribution of the token allocation. The only way to secure an allocation in this event if you are not whitelisted would be to be on the waiting list in the event that a purchaser drops out.

TGE

At the conclusion of the token sale the Forevver Association will distribute the tokens to each of the purchasers within 48 hours.

Exchange Listing

We fully anticipate that we will notify all of those who have registered an expression of interest well in advance of the Public Sale, regarding the imminent timing of DevvE listing on one or more exchanges.

Important

No member or Representative of DevvE or the Forevver Association will ever directly message requesting funds, personal details, private keys or other information which may relate to the token sale.

All correspondence will be managed via official channels and email. These messages can be confirmed by reaching out to the team.

Please verify any email you believe to be sent by DevvE and do not open any attachments or click on any suspicious links.