An update for our community

In the wake of our successful token launch, the Forevver Association recognises the need for trust and transparency regarding all things DevvE. We are in a unique position in the blockchain industry with a very strong technological advantage that’s capable of driving value creation in a whole new way that showcases the power of the DevvE ecosystem for business enablement.

This article will highlight:

- The DevvE Token Overview

- Why is DevvE an ERC20 token?

- DevvE Token Migration

- DevvE Circulation Schedule

- What is “Phase 2”

- DevvE Utility Overview

- Summary

We’ve recently updated our tokenomics in a way that makes learning in the discovery of DevvE, and the metrics that matter to our community, easily digestible. But first, we want to take a moment to communicate an important note to everyone reading this. As we have stated we are committed to transparency and we recognise the importance of earning the trust of all of our stakeholders. This commitment however is now being placed in conflict with requirements from many of our business partners and prospective customers. So while we wish we could share with you EXACTLY what’s been happening behind the scenes on our end, the reality is that when disruptive technologies are being employed in real world businesses applications by companies who are accountable to shareholders, these kinds of partners are extremely protective of any competitive advantages, until, quite frankly — it’s too late. Please understand in some cases, we might not be able to communicate to you about some of our joint endeavours until they are well into open deployment.

However, we don’t aim to build our reputation in the cryptocurrency market through partnership announcements alone — we know exactly what we have with our technology and we know what it can do! We’re confident that we have the most advanced and easy to use web3 platform that’s capable of empowering all developers to build the next generation of web applications incorporating all the past promises of blockchain technology — and substantially more!

The DevvE Token Overview

The only platform token for the DevvX Layer 1 blockchain.

- 8 Million TPS Cross-Shard Mechanism (fully operationally decentralized)

- Near infinite of inter-shard transaction throughput via horizontal scaling

- Sub Second Finality

- ⅓ billionth the energy consumption of Bitcoin (2.1J per txn)

- 3rd party certified as ISO Green Compliant

- 1/10 millionth the Cost of Ethereum

- User Privacy, while remaining transparent and auditable

- Protections from Fraud, Theft, Loss

- AMF ICO Visa approved (ICO.24–023)

- Regulatory Compliant

- Extensive Global Patents

Maximum Supply: 300 million

Contract address: 0x8248270620aa532e4d64316017be5e873e37cc09

Network & Exchanges: DevvE is actively traded on exchanges as an ERC20 cryptocurrency with the contract address above. It’s currently available on UniSwap, Gate.io, Bitpanda, MEXC and Bitget.

Please be vigilant when interacting with the contract address directly. DevvE does NOT currently exist in any other format, on any other network, under any other token address.

Why is DevvE an ERC20 token?

DevvE launched as an ERC20 — largely from a regulatory perspective. Its use on DevvX main net may require some additional regulatory compliance aspects depending on how the token will be specifically used in its utility, which is in the final stages of design and consultation. With the green light from the AMF to deploy as an ERC20, this enabled a fast route to market with exchange integrations, where the token can be used to tie-in to a robust DeFi ecosystem, and evolve into the other areas of utility when & where applicable.

It’s important to understand that the DevvE token has its own business model which reaches across all applications in the ecosystem. The use cases for DevvE that will be made available in the short term, such as staking to create verification nodes, are fully capable of being managed by the Forevver Association in ERC20 format. Where other properties of DevvE may be required, such as its use for a high speed and cost-effective payment mechanism in certain applications, this will likely require the token migration with careful review of all compliance factors.

DevvE Token Migration

We will migrate DevvE to DevvX using an Ethereum Bridge. This will happen in the future when all the aforementioned legal and business considerations have been checked off. There is no specific timeframe as this is beyond our immediate control.

Migration from ERC20 to DevvX is therefore not in any way constrained by either technical capability or requirement for DevvE to bridge to the DevvX mainnet. Bridging will occur when all factors have been appropriately addressed.

DevvE Circulation Schedule

We’ve consolidated the token issuances across 6 different categories as follows:

Private Round: 97,500,000 DevvE — 10 month daily vesting

Private Round tokens were executed by Devvio which supplemented funding for the development and commercialization of the DevvX blockchain software and initial applications. Private agreements were made at $0.27 & $0.35 per token, with the earliest of participants (2018) maintaining the option to convert their token allocations into Devvio equity.

Public Round: 6,000,000 DevvE — Fully Vested at TGE

The public round, including a FCFS period, was conducted in 2024 at $0.40 per token.

Marketing Budget: 13,5000,000 DevvE — 1.35m at TGE, then 24 month linear vesting

Allocated to the marketing team to create additional awareness, adoption, engagement and continued growth of the DevvE ecosystem over time.

Exchanges: 10,500,000 DevvE — 12 month linear vesting

For costs associated with exchange launches.

Liquidity:13,500,000 DevvE — 12 month linear vesting

Allocated for liquidity and the associated cost.

Team: 9,000,000 DevvE — 12 month cliff, then 24 month linear vesting

The Forevver Association’s Tokens: 150,000,000 DevvE

The remaining 150 million DevvE will remain in the custody of the Forevver Association. These tokens will typically not enter circulating supply unless they are purchased by governments, large enterprise or fund managers that will often be subjected to long term staking schedules (up to 10 years).

There may come a time where exceptions will need to be made, such as the opportunity to launch DevvE on a T1 exchange where additional tokens will be required for liquidity. The Forevver Association reserves the right to make these decisions from their pool of tokens and unequivocally state that this will only ever be considered in cases where there is a clear and definitive value add for all DevvE stakeholders.

We would also like to highlight that the maximum potential tokens vested in a calendar month is now going to be communicated as 10 million per month, instead of the previous 9 million. We want to reiterate that nothing materially changed in the tokenomics other than we are now accounting in the “worst case scenario” rather than the “most likely”. In our previous calculations, we assumed 10% of Private sales would convert to equity that we would launch with fewer exchange partners. Since we can’t predict exactly how many will convert (which could well be more than 10%) the only way we can give hard numbers and extend our token projections to 2028 is through accounting in this way.

What is “Phase 2”?

We have previously mentioned the concept of “Phase 2” which was documented in the original Whitepaper, where the Forevver Association may consider increasing the total supply of DevvE to an arbitrarily large 2.1B tokens in the future, and we need to clarify our methodology behind this and the deliverables that would need to be emphatically proven for this to ever be considered a reality.

It would naturally be many people’s first reaction to consider this as dilution, inflation or even a profiteering opportunity, with concerns regarding the immediate devaluation of any DevvE holdings. Increase in supply, in many minds equals decrease in overall demand and therefore a risk for token holders in terms of potential market manipulation or general bad faith actions from the team. There are multiple scenarios which broadly cover the same concerns and in order to address both the logic behind Phase 2 and why these concerns are unfounded, it is clear that we will need to provide further context.

To preface — when it comes to general currency inflation from a nation’s perspective, small levels of inflation are considered highly positive, towards stimulating economic growth and productivity in an economy. Likewise, the same rings true for crypto-economies, as long as there is a provable and measurable correlation between token issuances and value being captured in the ecosystem.

As one of the largest holders of DevvE and the custodian of both the ecosystem, its growth and its success, it is completely counterintuitive to think that the Forevver Association would risk devaluing the very thing that supports it. Any potential financial upside would immediately be offset by reputational damage at all levels from State and Government partners to ESG and Impact investors right through to our community of supporters and holders. The vision and requirements for any additional token release would therefore have to be supported by an incredibly strong economic driver.

A global value exchange capable of managing trillions of dollars worth of transactions, for example, may require a greater supply than the current market is capable of delivering. In order to drive frictionless growth it would be in everyone’s best interest to enable global adoption and scaling. So while it would selfishly benefit all of the current token holders (including the Forevver Association) to see the value of their holdings potentially skyrocket with this increased demand, this benefit would be short lived as friction increases and bottlenecks slow down adoption and scaling. This in turn would limit long term growth and provide a perfect opportunity for competitors. In this scenario a carefully timed trickle release of tokens would allow for both the increase of market share and market value, delivering a long and stable growth trajectory for all stakeholders.

Therefore if these Phase 2 tokens were required to be released they would ONLY be released in such a way as to not disrupt the market or devalue the tokens but to support the wider growth and adoption of DevvE. The Forevver Association, as the entity entrusted with benevolent management of the DevvE token, will not rule out any potential assets which may become a mechanism to accelerate the greater expansion in a way that benefits all stakeholders in the DevvE ecosystem.

We may not need this extra supply to complete our objectives, we are also confident that we will be able to execute on our value FlyWheel that will drive value and growth into the ecosystem. We will then be able to prove, plainly and clearly, how adding every token to the supply will be able to drive X amount of value in the network. The key understanding here is we need to remain flexible. We are confident to execute on our vision while maintaining a positive supply / TVL ratio because it further empowers us as a non-profit organization.

DevvE Utility Overview

We believe there is uncapped potential in the application of DevvE within our ecosystem, on par with how the data transfer on the internet matured into unpredictable applications that inspired the functionality and use cases of the modern web3. As we allude to in the section about the bridging DevvE to the DevvX main net, there are certain use cases, which due to regulatory frameworks and the best interest of everyone in mind, we can’t publicly speak with ultimate transparency on every planned use case until certain key events occur.

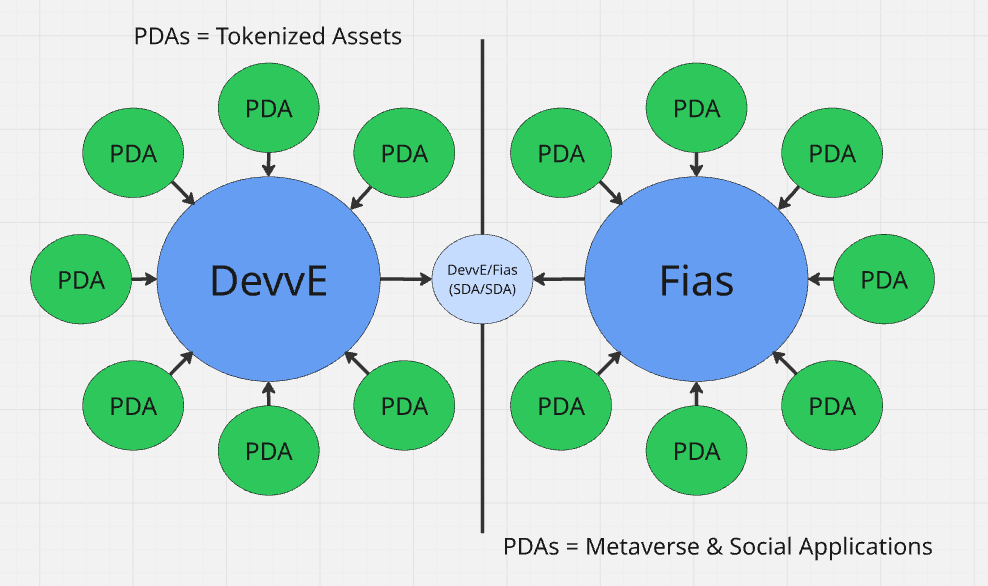

While some of the utility functions of DevvE have been made publicly available, we can use these to help build a mental framework to understand how token utility can be applied across the ecosystem, depending on the demands of a specific application.

Let’s break these down into 4 distinct categories:

- Application Specific Staked: Eg, access to a platform such as a launchpad or for a discount in receiving products and services.

- Application Specific Unstaked: Eg, use as a high speed payment mechanism, or utility as a scalable exchange trading pair.

- Network Specific Staked: Eg, in the creation of a verification node.

- External DeFi: Eg, uniSwap liquidity mining or trading.

All applications in development in the DevvE ecosystem, by matter of design, will drive token utility demand in at least one of these 4 categories and up to potentially all 4 depending on the application. Each of these serve to either increase demand (inherent in the applications leveraging the advanced qualities of DevvE), or reduce supply (because of the simple existence of the application to begin with).

It’s important to note that “staking” in the context of the DevvE ecosystem is considered as simply an agreement to lock up tokens for a specified period of time to gain access to the ecosystem’s advanced features and functionalities and not as part of the network security mechanism.

Here are some example token utility use cases which could be derived from our first party applications:

Staking to create verification nodes

Staking to receive priority access to impact offsets

Staking as a mechanism to participate in shard governance

Staking for reduction in application costs / fees

Staking for access to product offerings (eg launchpad)

Staking to receive token rewards

As a reward to validators for providing a service (per shard governance)

As a payment mechanism for ESG offsets

As a medium of exchange

For scalable liquidity and trading pair functionality

Liquidity Mining

Exchange related function and activity

Summary

Lastly, and arguably most importantly for those who are approaching the DevvE ecosystem from the crypto side of our technology, the ultimate question we aim to answer for governments, enterprise and web developers is how can my specific business leverage this enabling technology to build value *or dramatically reduce operational costs* for my business to present a clear competitive advantage.

There is a laundry list of ways the DevvE ecosystem can do this. So we encourage you to think of your favourite global 2000 company, place this mental model over and see if you can come up with the next new killer apps that will draw the eyes of the world. If you do, we’ll see you for our DevvE Innovation Grant Shard (DIGS) Program.

In essence, DevvE isn’t just a token; it’s a catalyst for innovation and value creation. Whether you’re a government entity, enterprise, or web developer, the DevvE ecosystem offers boundless opportunities to build impactful solutions and drive global change.

Join us as we embark on this thrilling journey of innovation and progress. Together, let’s shape the future of technology and business!

Your DevvE Team.

Important Disclaimer

The Forevver Association does not now or ever intend to represent or infer that the DevvE token could in any way be considered a security. The information presented herein, and any other materials provided by the Forevver Association are intended only for discussion purposes and are not intended as, and do not constitute, an offer to sell or a solicitation of an offer to buy any security and should not be relied upon by you in evaluating the merits of investing in any securities. These materials are not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use is contrary to local law or regulation. The information contained herein does not purport to contain all the information that may be required to evaluate an investment in Forevver’s tokens, assets or securities. A prospective investor should only commit to an investment in DevvE if such prospective investor understands the nature of the investment and can bear the economic risk of such investment. DevvE is speculative and involves a high degree of risk. DevvE’s performance may be volatile. There can be no guarantee that DevvE’s objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of his, her or its investment. In addition, Forevver’s expenses may offset its profits. Nothing herein is intended to imply that Forevver’s methodology may be considered “conservative”, “safe”, “risk free” or “risk averse”. In making an investment decision, you must rely on your own examination of Forevver and DevvE and the terms of any offering. The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting, or other advisors about the matters discussed herein. Forevver’s ability to achieve its objectives may be affected by a variety of risks not discussed herein. Past performance is not indicative or a guarantee of future results Forevver believes the information contained in this document to be reliable but makes no warranty or representation, whether express or implied, and assumes no legal liability for the accuracy, completeness or usefulness of any information disclosed. The estimates, investment strategies, and views expressed in this document are based upon current market conditions and/or data and information provided by unaffiliated third parties and are subject to change without notice. Forevver is an early-stage entity, and as such, reserves the right to make changes to its business plans, the DevvE token, and DevvE tokenomics as needed to further its business objectives.

Source: https://medium.com/@DevveEcosystem/devve-tokenomics-update-5b0cf16c1f56